Asbury’s strategic focus on vehicle maintenance and parts has proven to be a wise move. With a consistent demand for vehicle servicing, the company has created a buffer against the cyclical nature of car sales. This division has not only provided stable revenue but also boasts higher profit margins compared to vehicle sales.

The company’s recent earnings reports have underscored the strength of its parts and service segment, which has consistently outperformed other areas. Asbury’s emphasis on customer service excellence and efficiency in operations has led to repeat business and customer loyalty, which are critical in driving long-term revenue growth.

Navigating Market Shifts

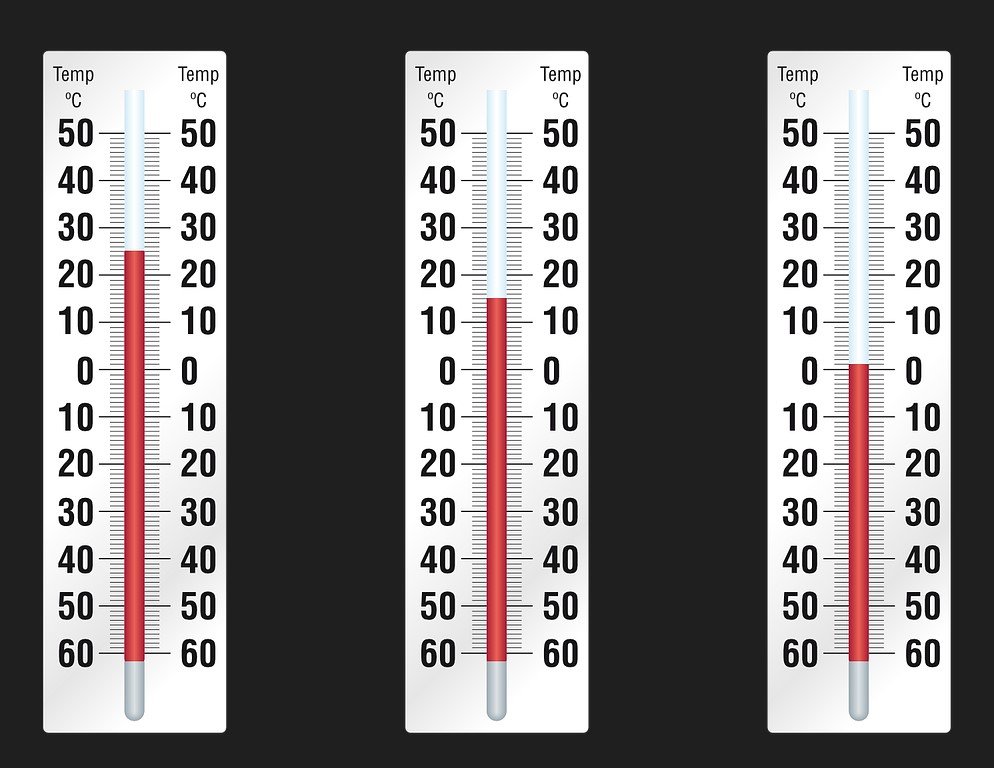

In the face of economic headwinds and a potential downturn in new car sales, Asbury’s maintenance segment stands as a beacon of resilience. The company’s ability to adapt to market changes and focus on high-margin services positions it well to navigate through periods of uncertainty.

Asbury’s stock has shown relative strength, supported by the company’s solid financials and a strategic emphasis on maintenance services. Investors have taken note of Asbury’s diversified revenue streams, which provide a hedge against the volatility of new vehicle sales.

Revving Up for the Future

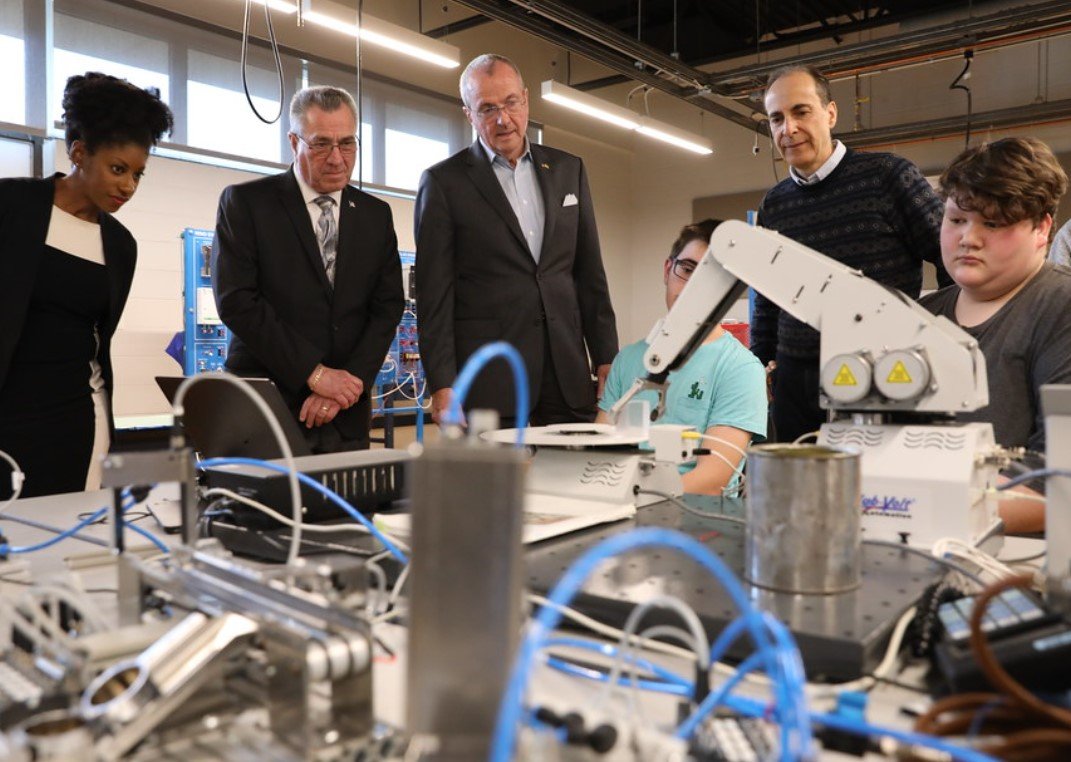

Looking ahead, Asbury is well-positioned to capitalize on trends such as the increasing complexity of vehicles and the growing need for specialized maintenance. The company’s investment in training and technology ensures that it remains at the forefront of service provision, ready to meet the evolving demands of the automotive market.

Asbury’s commitment to expanding its maintenance services is not just about sustaining revenue; it’s about building a foundation for future growth. The company’s stock reflects the potential for steady gains, driven by a sector that keeps the wheels of the automotive industry turning.