Hilton’s aggressive growth strategy is marked by its recent acquisitions, including Foppen and Dalco, which have significantly bolstered its market presence. The company’s expansion into new territories, such as the full year of trading in New Zealand and a partnership in Singapore with Country Foods, underscores its commitment to becoming a global powerhouse.

The company’s resilience in the core meat category, coupled with its ventures into the vegan and vegetarian sectors through branded partnerships, demonstrates a versatile and forward-thinking approach. Despite challenges in the seafood sector, Hilton has laid out robust recovery plans to restore profitability and maintain its market leadership.

Technological Innovation and Sustainable Practices

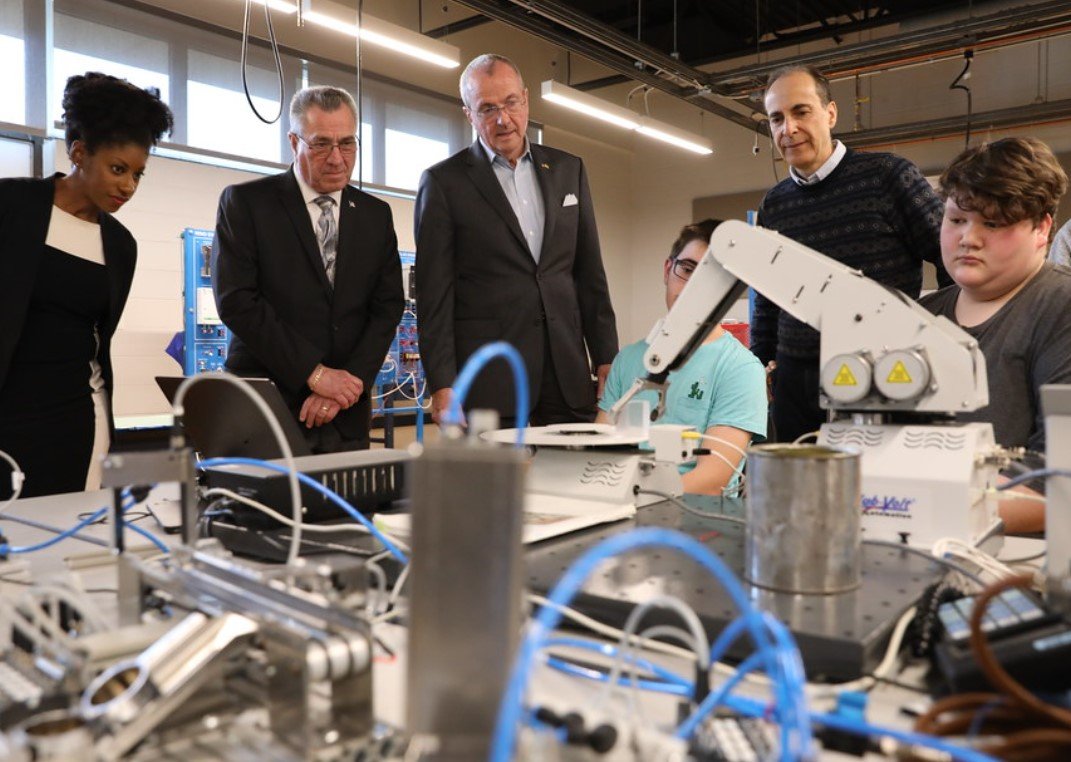

Hilton’s investment in technology, such as increasing ownership of the Foods Connected supply chain management platform and the Agito joint venture, reflects its dedication to innovation. These advancements are not just about staying ahead of the competition; they’re about reshaping the industry and setting new standards for efficiency and sustainability.

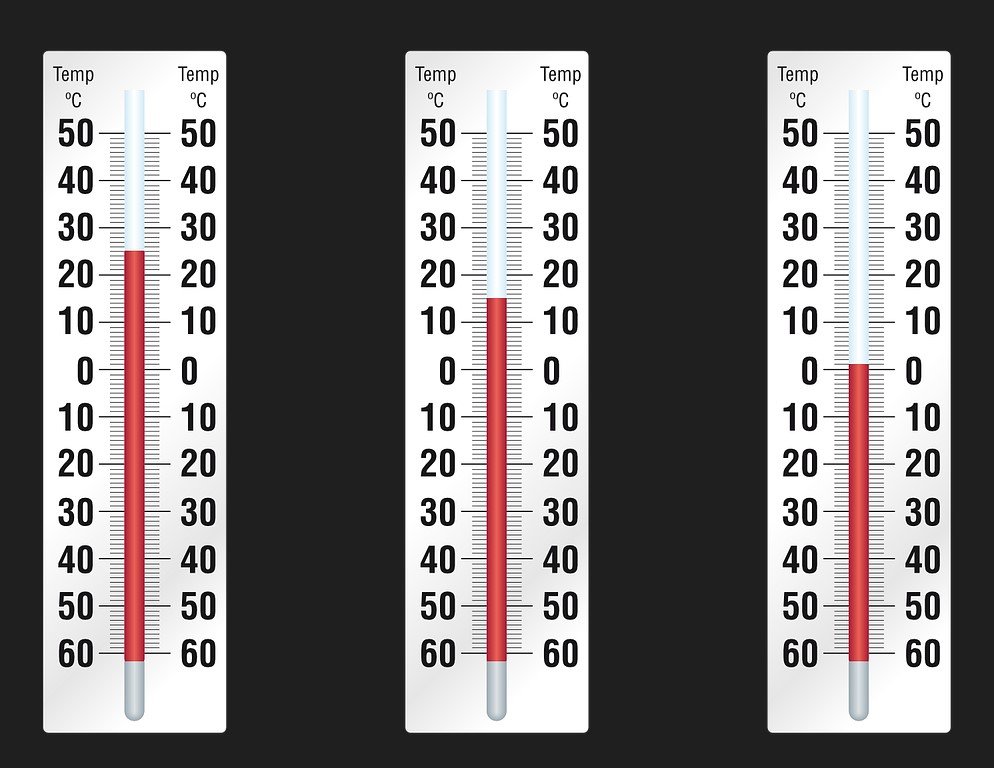

The company’s Sustainable Protein Plan, which introduces ESG performance metrics into its LTIP Scheme, is a testament to its commitment to environmental stewardship. Hilton’s progress across people, planet, and product pillars, including exceeding its 2025 target for women in leadership positions and an A- rating from CDP on Climate Change, positions it as a leader in corporate responsibility.

Financial Fortitude and Future Outlook

Despite a challenging global environment marked by uncertainties and inflation, Hilton’s financial overview remains strong. With group revenue up by 16.5% to £3.8 billion and volume growth of 4.3%, the company is well-positioned for the year ahead. Its robust cash flows and strong balance sheet, following significant investments in acquisitions and capital expenditure, provide a solid foundation for sustained growth and shareholder value.

Hilton’s outlook is optimistic, with short and medium-term growth prospects underpinned by its strategic acquisitions and partnerships. The company’s ability to navigate the complexities of the global market while continuing to innovate and expand its cross-category business bodes well for its future ambitions.