In the vast ocean of investment opportunities, Omega Healthcare Investors Inc. (NYSE:OHI) stands out with a siren’s call of a 9% yield. But is this yield a safe harbor for investors, or will it prove to be a treacherous shoal? This article sets sail to explore the stability and sustainability of Omega Healthcare’s high dividend yield.

Omega Healthcare, a real estate investment trust (REIT), has long been a darling for income-focused investors. The company’s portfolio, heavily invested in long-term healthcare facilities, has provided a steady stream of rental income, which in turn fuels its generous dividends.

However, the healthcare sector is not without its challenges. Regulatory changes, shifts in Medicare and Medicaid reimbursements, and the ever-present specter of economic downturns can all impact Omega’s bottom line. Despite these potential headwinds, Omega has maintained a consistent payout, raising the question: How does Omega keep its dividends afloat?

A Deep Dive into Dividend Safety

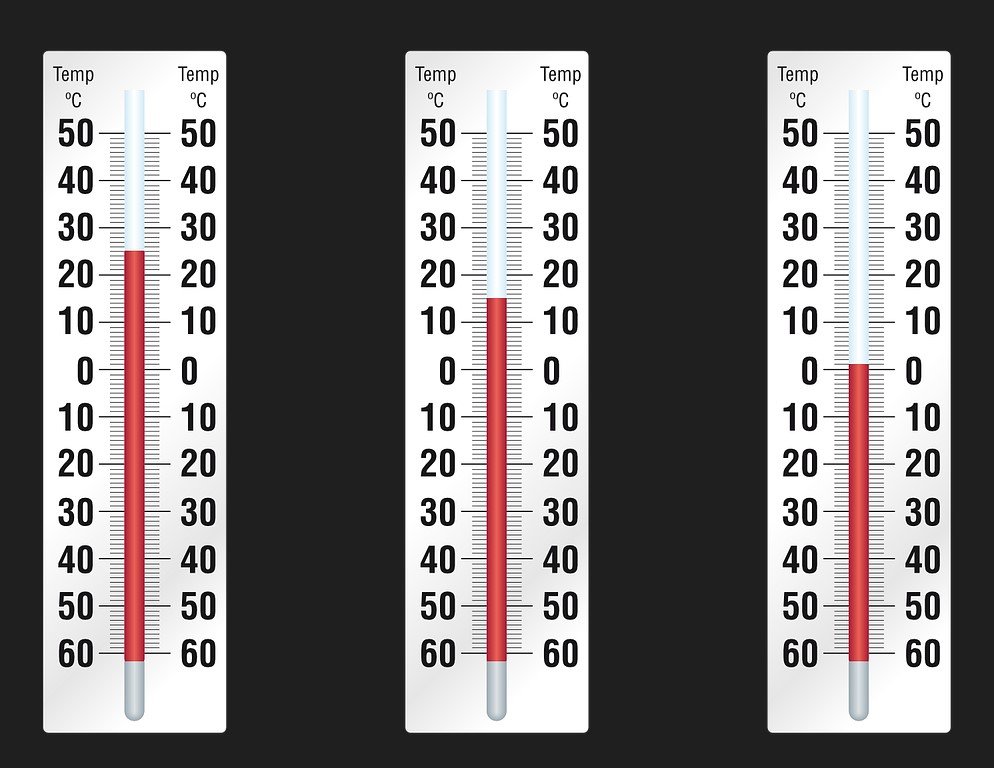

To assess the safety of Omega’s yield, one must consider the payout ratio, the proportion of earnings paid out as dividends. A payout ratio over 100% can be a red flag, indicating that a company is paying more in dividends than it earns, which is unsustainable in the long run.

Omega’s payout ratio has flirted with this threshold, yet the company’s strategic acquisitions and management of assets have kept it from crossing the line. By carefully navigating the waters of the healthcare industry, Omega has managed to keep its dividends well-provisioned.

Charting the Course Ahead

Looking to the horizon, Omega Healthcare’s future dividend safety will hinge on its ability to adapt to the changing tides of the healthcare industry. With an aging population and increasing demand for long-term care facilities, the company’s focus could prove prescient.

Yet, investors must remain vigilant, keeping a weather eye on the factors that could affect Omega’s ability to continue its dividend payments. For now, Omega’s 9% yield appears to be a buoyant vessel, but only time will tell if it can weather future storms.